TAXLINK

Frequently Asked Questions

What is TAXLINK?

TaxLink is a web-based Property Tax Management System. It can be used by both County Assessor staff, County Attorney staff, and Municipality Appraisers to manage Property Tax Petition Cases.

How does it work?

County Staff create cases in TaxLink. Information about each PID is entered. Once a case has been created, it is sent automatically to the Minnesota Tax Court. Then, any staff that are on the case can add notes, events, and Scheduling Orders.

As cases complete, there is a workflow system that appraisers can use to enter the outcome per PID, such as new stipulated values or entering a dismissal. Then, the workflow sends it to their supervising appraiser who can approve or deny it before it gets posted in TAXLINK as the new values.

Reports

TAXLINK can produce reports such as

-

Closed Cases: This shows details and gives grand totals for all petitions closed in a date range. It shows the total values before the cases were petitioned, and the new values after they were stipulated.

-

Assessor Workload Statistics: This shows each appraiser, and gives totals of their cases in a date range, broken down by the phase of a case (open, in trial, closed).

Document Production

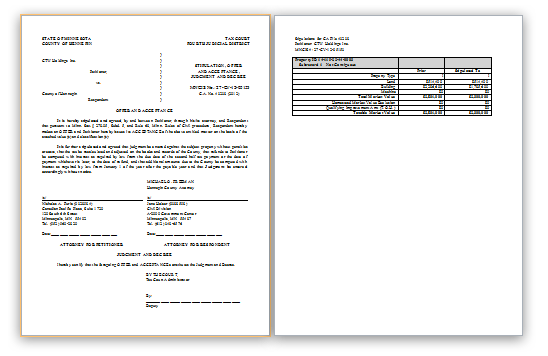

TAXLINK can produce any type of document that you need, in MS Word format, such as the Stipulations, Dismissals, Notices of Duplicate Filings, etc.

What about Documents and File Attachments?

Users can upload and store any documents, files or attachments to a case, so that they can be stored and viewed by all staff that are working on that case. This also helps offices who are trying to go paperless.

How much does it cost?

TAXLINK is very reasonably priced. Accounts are billed monthly, and you may add/remove accounts at any time.

How can I see a demo?

Visit http://TAXLINKUS.com for a demo of the TAXLINK software.

Use our Request Info page to request a TAXLINK Demo for your County.